SDEX Soars 160% After Smardex Unveils Unified DeFi Protocol

SDEX jumped more than 160% after Smardex announced its shift to the unified protocol, which merges a DEX, lending market and perpetual-style trading into a single smart contract and liquidity pool.

A Unified Architecture for Capital Efficiency

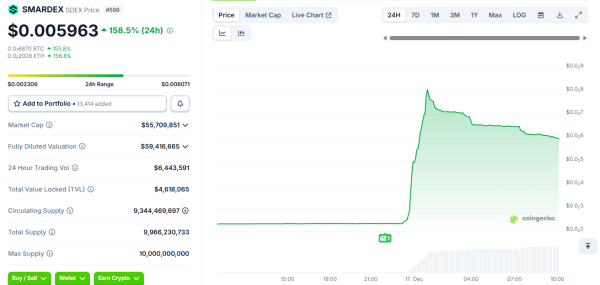

The native token of the decentralized finance (DeFi) platform Smardex (SDEX) surged by over 160% on Dec. 17, following the announcement of its transition to a unified protocol that integrates a decentralized exchange (DEX), a lending market, and a perpetual-style trading system into a single smart contract. Market data shows the token rallied from approximately $0.002 to a brief peak above $0.008 before settling near $0.006.

The rally pushed SDEX’s market capitalization from $21 million to over $56 million, securing its place as one of the day’s top market gainers. Reacting to the token’s surge, Jean Rausis, a co-founder at Everything, said the price action shows that its community “didn’t just show up—it went wild.” Rausis added that the surge is “a testament to the strength of our platform and the massive anticipation for our upcoming evolution.”

According to a media statement, the unified protocol also known as the Everything protocol represents a fundamental shift away from fragmented DeFi primitives. Unlike traditional ecosystems where users must navigate separate platforms for swapping, borrowing, and leveraged trading, Everything executes all core functions through a single smart contract and a unified liquidity pool.

This architecture utilizes an oracle-less leverage engine to execute trades atomically and a tick-based borrowing model designed to limit bad debt through deterministic collateral requirements. By housing all operations in a single pair, the system removes the need for fragile integrations and external price feeds.

“Our goal with Everything is not only to improve DeFi mechanics but to redefine how teams build financial infrastructure on-chain,” said Rausis. “We designed this protocol so new projects can launch markets and liquidity layers without relying on fragmented integrations. This shift provides a foundation that supports real scale and1 long-term stability.”

Scheduled for an official launch in February 2026, Everything layers permissionless lending and borrowing atop the classic xy = k AMM model. Unutilized collateral within the system is repurposed through a shared vault, which deploys idle funds into approved external yield strategies to reduce borrowing costs for users.

To further boost capital efficiency, Everything pairs liquidity with USDNr, a decentralized synthetic stable asset that offers a sustainable yield of approximately 16% APR. Liquidity providers (LPs) can earn this yield alongside swap fees, borrowing interest, funding rates, and liquidation penalties, creating a multi-layered revenue stream within a self-balancing system.

Looking ahead, the protocol has already teased the “Geneve” upgrade planned for summer 2026. This major release aims to achieve “100% capital efficiency” by introducing yield-bearing collateral and native limit orders. Under the new model, even idle waiting orders will generate yield, ensuring that every dollar within the ecosystem is constantly productive.

FAQ ❓

- Why did SDEX surge more than 160%? The token jumped after Smardex announced its unified “Everything” protocol combining DEX, lending and perpetual trading in one contract.

- What makes the Everything protocol different? It replaces fragmented DeFi platforms with a single smart contract and unified liquidity pool for all core functions.

- How does the system improve stability and efficiency? It uses an oracle‑less leverage engine, deterministic collateral rules and a shared vault that deploys idle collateral into yield strategies.

- What upgrades are planned next? The 2026 “Geneve” release aims for full capital efficiency by adding yield‑bearing collateral and native limit orders.

Post Comment